Test based on the autoregressive spectrum

AR Spectrum definition

The spectral density at frequency \(\lambda \in [0,\pi]\) of an AR(p) process with innovation variance \(var(x_{t})=\sigma^2_x\) is expressed as follows:

\[10\times log_{10} f_x(\lambda)=10\times log_{10} \frac{\sigma^2_x}{2\pi \left|\phi(e^{i\lambda}) \right|^2 }=10\times log_{10} \frac{\sigma^2_x}{2\pi \left|1-\sum_{k=1}^{p}\phi_k e^{i k \lambda}) \right|^2 }\]where \(\phi_k\) denotes the AR(k) coefficient, and \(e^{-ik\lambda}=cos(-ik\lambda)+i sin(-ik\lambda)\).

Soukup and Findely (1999) suggest the use of p=30, which in practice much larger than the order that would result from the AIC criterion. The minimum number of observations needed to compute the spectrum is set to n=80 for monthly data (or n=60) for quarterly series. In turn, the maximum number of observations considered for the estimation is n=121. This choice offers enough resolution, being able to identify a maximum of 30 peaks in a plot of 61 frequencies: by choosing \(\lambda_j=\pi j/60\),for \(j=0,1,…,60\), we are able to calculate our density estimates at exact seasonal frequencies (1, 2, 3, 4, 5 and 6 cycles per year). Note that \(x\) cycles per year can be converted into cycles per month by simply dividing by twelve, \(x/12\), and to radians by applying the transformation \(2\pi(x/12)\).

The traditional trading day frequency corresponding to 0.348 cycles per month is used in place of the closest frequency \(\pi j/60\). Thus, we replace \(\pi 42/60\) by \(\lambda_{42}=0.348\times 2 \pi = 2.1865\). The frequencies neighbouring \(\lambda_{42}\) are set to \(\lambda_{41}= 2.1865-1/60\) and \(\lambda_{43}= 2.1865+1/60\). The proximity of this trading day frequency \(\lambda_{42}\) to the frequency corresponding to 4 cycles per year \(\lambda_{40}=2.0944\) can pose identification problems. The contribution of the trading day frequency may be obscured by the leakage resulting from the potential seasonal peak at \(\lambda_{40}\), and vice-versa.

Jdemetra+ allows the user to modify the number of lags of this estimator and to change the number of observations used to determine the AR parameters. These two options can improve the resolution of this estimator.

Graphical Test

The statistical significance of the peaks associated to a given frequency can be informally tested using a visual criterion, which has proved to perform well in simulation experiments. Visually significant peaks for a frequency \(\lambda_{j}\) satisfy both conditions:

- \(\frac{f_{x}(\lambda_{j})- \max \left\{f_{x}(\lambda_{j+1}),f_{x}(\lambda_{j-1}) \right\}}{\left[ \max_{k}f_{x}(\lambda_{k})-\min_{i}f_{x}(\lambda_{i}) \right]}\ge CV(\lambda_{j})\), where \(CV(\lambda_{j})\) can be set equal to \(6/52\) for all \(j\)

- \(f_{x}(\lambda_{j})> median_{j} \left\{ f_{x}(\lambda_{j}) \right\}\), which guarantees \(f_{x}(\lambda_{j})\) it is not a local peak.

The first condition implies that if we divide the range \(\max_{k}f_{x}(\lambda_{k})-\min_{i}f_{x}(\lambda_{i})\) in 52 parts or stars, the height of each pick should be at least 6 stars.

Jdemetra+ exploits critical values for \(\alpha=1\%\) (code “A”) and \(\alpha=5\%\) (code “a”) . Agustin Maravall has proposed has conducted a simulation experiment to calculate \(CV(\lambda_{42})\) (trading day frequency) and proposes to set for all \(j\) equal to the critical value associated to the trading frequency.

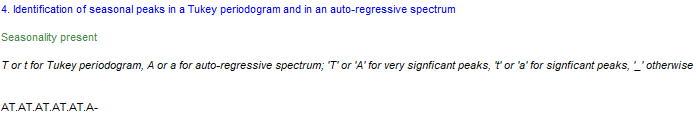

Example of how results are displayed:

References

- Soukup, R.J., and D.F. Findley (1999) On the Spectrum Diagnosis used by X12-ARIMA to Indicate the Presence of Trading Day Effects After Modeling or Adjustment. In Proceedengs of the American Statistical Association. Business and Economic Statistics Section, 144-149, Alexandria, VA.